Hong Kong Monetary Authority Loosens Mortgage Ratios: Properties Priced Under 15 Million HKD Can Borrow Up to 70% - Clear Review of the New Policy

The Hong Kong Monetary Authority (HKMA) recently announced a relaxation of mortgage ratios, the first time in more than a decade. For properties priced under 15 million HKD, buyers can now obtain a mortgage loan of up to 70%. This article will provide a detailed introduction to the new policy and analyze its impact on prospective market entrants.

The Hong Kong Monetary Authority (HKMA) recently announced a relaxation of mortgage ratios, the first time in more than a decade. For properties priced under 15 million HKD, buyers can now obtain a mortgage loan of up to 70%. The new policy is effective immediately. HKMA chief executive, Mr. Eddie Yue Wai-man, stated that the authority aims to maintain the robustness of the banking system while minimizing the inconvenience of the measures on property purchases. After considering property price trends, transaction volume, local economy, and interest rate environment, they believe there is room for relaxed mortgage measures. This article will provide a detailed introduction to the new policy and analyze its impact on prospective market entrants.

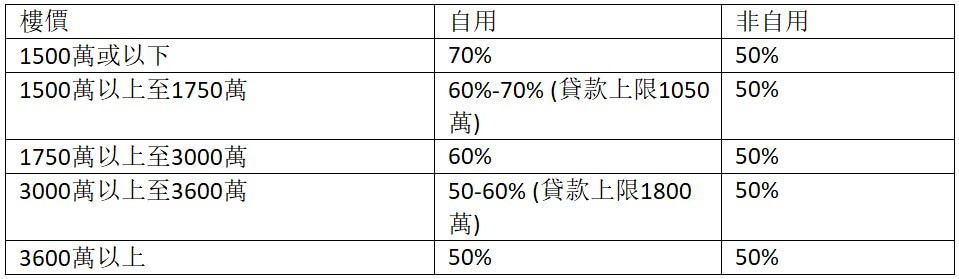

2023 Property Market Policy - Residential Properties

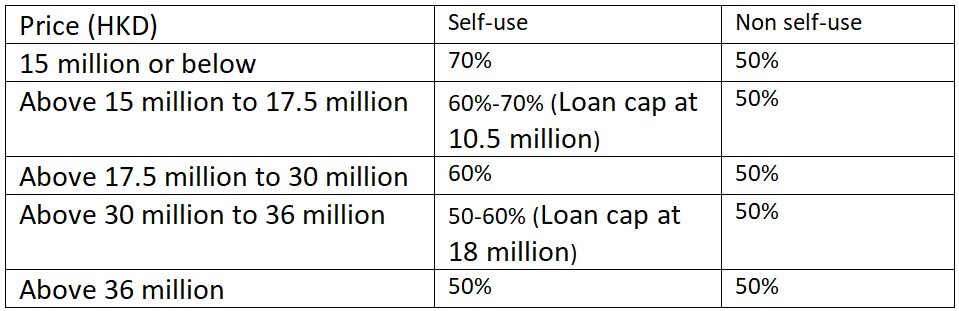

According to the new policy by the HKMA, the mortgage ratio rules for residential properties are adjusted as follows:

- For residential properties valued 15 million HKD or below, the maximum mortgage ratio is increased to 70%.

- For residential properties valued between 15 million and 17.5 million HKD, the mortgage ratio is 60-70%.

- For residential properties valued between 17.5 million and 30 million HKD, the mortgage ratio is 60%.

- For residential properties valued between 30 million and 36 million HKD, the mortgage ratio is 50-60%.

- For residential properties valued over 36 million HKD, the mortgage ratio is 50%.

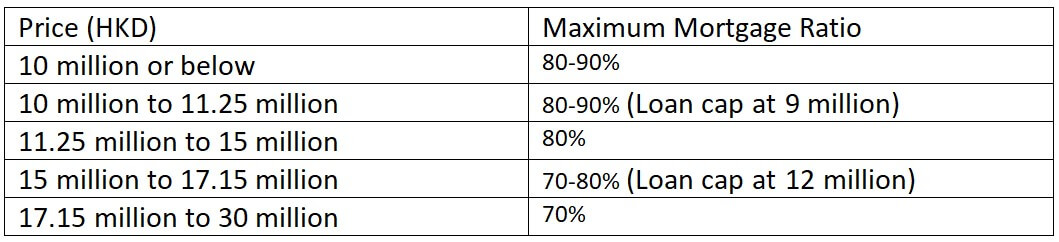

Latest Mortgage Ratios for Residential Properties (No Mortgage Insurance, Based on Income)

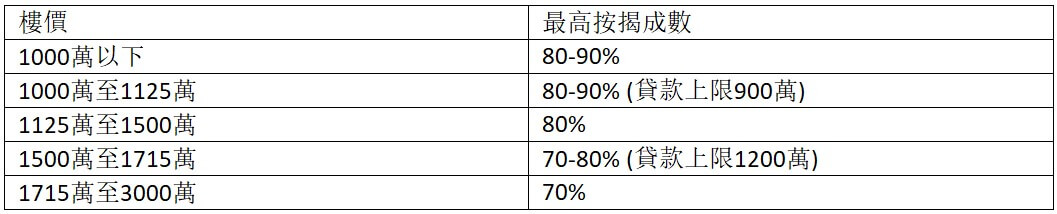

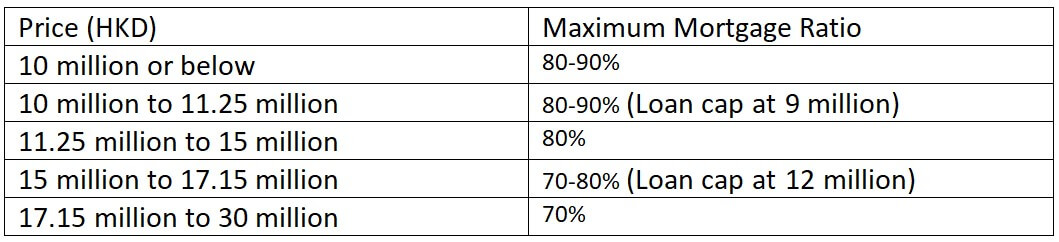

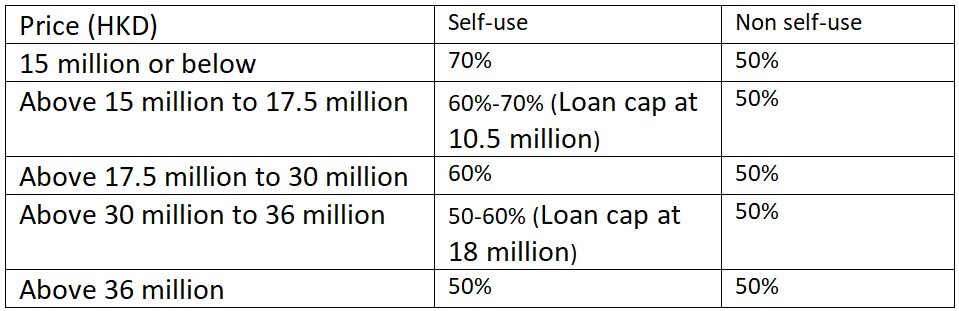

Latest Mortgage Ratios with Mortgage Insurance

For a property priced at 15 million HKD, the initial mortgage payment has been reduced from 7.5 million HKD (50%) to 4.5 million HKD (30%), a significant reduction of 3 million HKD (20%). Furthermore, as banks can now provide a maximum of 70% mortgage, insurance plans will offer insurance for amounts exceeding the 70% mortgage ratio, with related premiums being lower than those above the 60% ratio, easing the financial pressure on buyers. It is expected that many owners of 15 million HKD units will switch from a 50% to a 70% mortgage and cash out.

Search for properties under 15 million in Hong Kong Island

The implementation of the new policy is undoubtedly good news for clients intending to buy properties, expanding buyers' options and facilitating families to upgrade to larger properties. Properties priced between 10 million and 30 million HKD are expected to be more attractive.

However, the mortgage ratio cap for non-owner-occupied residential properties (for rent) remains at 50%.

2023 Property Market Policy - Non-residential Properties

The HKMA has also adjusted the maximum mortgage ratio for non-residential properties, such as offices, shops, and industrial buildings, increasing it from the current 50% to 60%. For instance, for a commercial property worth 10 million HKD, the initial payment was 5 million HKD (50%), but with the new policy, it is now only 4 million HKD. The difference between the old and new policy is 1 million HKD.

Chief Executive Eddie Yue stated that residential property prices have fallen by 13% since June this year from the 2021 peak, and the non-residential property market has also declined from its peak in 2018 to 2019. Furthermore, interest rates may be higher in the future, and the slowing global economic growth may also affect the local economy. After the adjustment of mortgage restrictions by the HKMA, more flexible financial arrangements can be made for property buyers

We will pay close attention to market dynamics and provide you with the latest market information and professional real estate services. If you plan to buy a property or have questions about the impact of the new policy, please feel free to Contact us .

Previous Article School Net 18: Top Schools & Properties in HK's Southern District

Next Article Stamp Duty Refund Policy and ASMTP Heat Up Property Market in Hong Kong

2023 Property Market Policy - Residential Properties

According to the new policy by the HKMA, the mortgage ratio rules for residential properties are adjusted as follows:- For residential properties valued 15 million HKD or below, the maximum mortgage ratio is increased to 70%.

- For residential properties valued between 15 million and 17.5 million HKD, the mortgage ratio is 60-70%.

- For residential properties valued between 17.5 million and 30 million HKD, the mortgage ratio is 60%.

- For residential properties valued between 30 million and 36 million HKD, the mortgage ratio is 50-60%.

- For residential properties valued over 36 million HKD, the mortgage ratio is 50%.

Latest Mortgage Ratios for Residential Properties (No Mortgage Insurance, Based on Income)

Latest Mortgage Ratios with Mortgage Insurance

For a property priced at 15 million HKD, the initial mortgage payment has been reduced from 7.5 million HKD (50%) to 4.5 million HKD (30%), a significant reduction of 3 million HKD (20%). Furthermore, as banks can now provide a maximum of 70% mortgage, insurance plans will offer insurance for amounts exceeding the 70% mortgage ratio, with related premiums being lower than those above the 60% ratio, easing the financial pressure on buyers. It is expected that many owners of 15 million HKD units will switch from a 50% to a 70% mortgage and cash out.

Search for properties under 15 million in Hong Kong Island

The implementation of the new policy is undoubtedly good news for clients intending to buy properties, expanding buyers' options and facilitating families to upgrade to larger properties. Properties priced between 10 million and 30 million HKD are expected to be more attractive.However, the mortgage ratio cap for non-owner-occupied residential properties (for rent) remains at 50%.

2023 Property Market Policy - Non-residential Properties

The HKMA has also adjusted the maximum mortgage ratio for non-residential properties, such as offices, shops, and industrial buildings, increasing it from the current 50% to 60%. For instance, for a commercial property worth 10 million HKD, the initial payment was 5 million HKD (50%), but with the new policy, it is now only 4 million HKD. The difference between the old and new policy is 1 million HKD.Chief Executive Eddie Yue stated that residential property prices have fallen by 13% since June this year from the 2021 peak, and the non-residential property market has also declined from its peak in 2018 to 2019. Furthermore, interest rates may be higher in the future, and the slowing global economic growth may also affect the local economy. After the adjustment of mortgage restrictions by the HKMA, more flexible financial arrangements can be made for property buyers

We will pay close attention to market dynamics and provide you with the latest market information and professional real estate services. If you plan to buy a property or have questions about the impact of the new policy, please feel free to Contact us .

Previous Article School Net 18: Top Schools & Properties in HK's Southern District

Next Article Stamp Duty Refund Policy and ASMTP Heat Up Property Market in Hong Kong

22 JUL 2023